- Servicemanagement

- Inrichtingsvraag insturen

- Aanvragen servicemanagement

- Optimalisatiesessies

- Systemintegrator

New in Profit 3

Construction

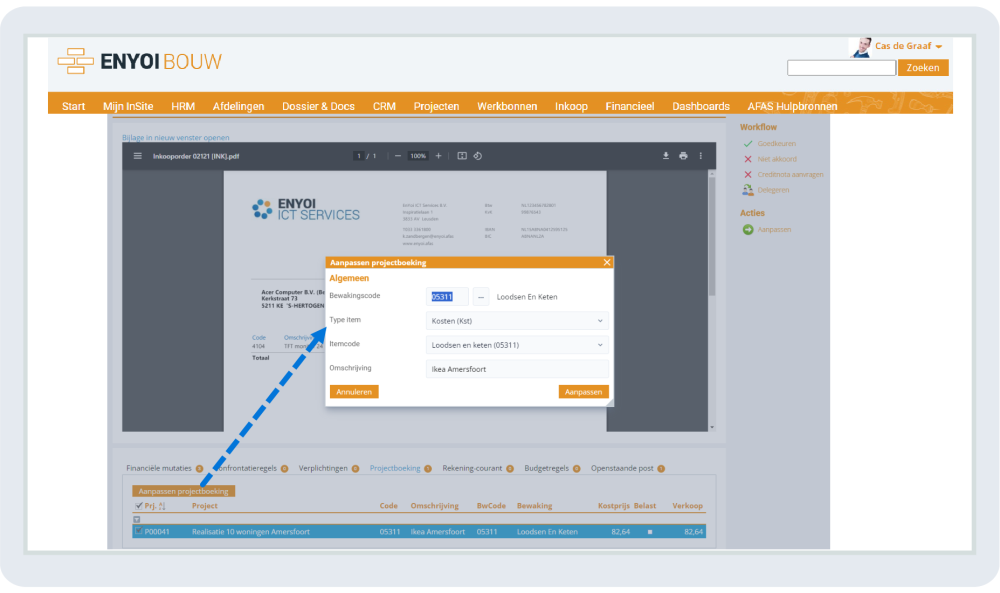

Change purchase invoice security code

It is now possible to change the project entry through InSite while reviewing the workflow purchase invoice. In Profit, you can go directly to the project entry instead of opening the journal entry first. For this purpose, the Adjust project entry page has been added in InSite. These are the Cost type, Item code, Description and Security code fields in InSite. In Profit, you can change the entire project entry.

Small calculations

You can now make small calculations in Profit. This includes things like additional or less work. The advantage is that you no longer separately have to go to a calculation programme, saving you time and effort.

In doing so, you take into account the standard hours - what is usual qua hours x the average wage rate (what has been agreed with the client). When reading the CUF file, we now do the same. The 'generic start-up costs calculation' is also included in the small calculation.

This functionality has been patched in Profit 3.

Start-up costs in Profit

Per cost estimate, you now also calculate your start-up costs in Profit. Long awaited and now it’s here! These are indirect costs including general construction costs, lost time, risk and CAR. It is also possible to set up your own two custom start-up costs.

Which start-up costs you use and how high they should be can be set as defaults: at a high level in the project settings, per project group, project and also per cost estimate.

This functionality will be patched in Profit 3. (OK, so a slightly longer wait).

Option list functionality optimised

The following optimisations have been implemented regarding the option list:

Now when you add a new option list and create a cost estimate from there, Profit starts the cost estimate as a sub-entry screen without saving the option list first. Previously, this did happen, which could cause notifications to appear incorrectly.

This was linked to the functionality for closure dates. Now, when you change the closing dates in a project, you get a message that someone is in the option list and this cannot be changed.

- When cancelling a new option list with a new cost estimate, the cost estimate remained. Now the new cost estimates is also deleted.

Price revision on invoice total (Belgium)

There has been an optimisation compared to the price revision on invoice total.

When calculating with one factor, we are going to revise on the total value and thus only round up to one total amount. This avoids possible 'penny' differences between the calculation in Profit and the Belgian government as the client.

The old 'revision per line' situation, where different factors can be applied and where amounts are rounded up per line, remains available.

This functionality will be patched in Profit 3.

More great functionality

- Column colour and Red for negative

In the working budget, you can colour or bold the columns again. This makes things very clear. Even nicer is the fact that you can let Profit make the negative amounts in a column red! Check it out!